Breaking free from pharmaceutical tariffs! Can innovative drugs accelerate overseas expansion by 2025?

On May 6, the U.S. government announced plans to unveil new pharmaceutical tariff measures within the next two weeks. Can innovative drugs accelerate overseas expansion by 2025?

Under current U.S. policy, pharmaceuticals are classified as tariff-exempt goods, so the potential introduction of drug tariffs has stirred volatility across global biotech markets.

However, Chinese innovative drugmakers are barely affected by such tariff risks.

There are two main reasons:

First, China’s pharmaceutical exports are still dominated by generics, while the value of innovative drug exports remains minimal.

Second, Chinese biopharma companies generate most of their overseas profits through intellectual property (license-out) transactions rather than physical exports. These IP-based deals are not subject to customs duties.

For example, when a diabetes drug’s R&D results are licensed to a foreign company, the partner handles production and sales abroad—bypassing tariff barriers entirely.

Further challenges facing Chinese innovative drugs going global can be found in this article: China’s pharmaceutical breakthroughs face major tests in going global.

Three Models of China’s Pharmaceutical Globalization, innovative drugs accelerate overseas

(1) Independent Expansion — “Going Alone”

According to DengYueMed, the integration of AI not only empowers drug discovery but also enhances regulatory efficiency—potentially accelerating overseas market access for Chinese pharmaceutical innovators.

| Overseas Expansion Model(Core Logic) | Independent Expansion(Full Autonomy) | Collaborative Expansion(Partial Autonomy) | Partnered Expansion(Shared Interests) |

|---|---|---|---|

| Business Model | Conducts international clinical trials and product launches independently, and establishes its own commercialization team post-approval. | Chinese pharma companies actively seek overseas partners with strong commercialization capabilities and clinical experience to jointly promote drug development. | Licenses overseas development and commercialization rights to multinational partners, receiving upfront payments, milestone payments, and sales-based royalties. |

| Relative Benefits | Enjoys full control and profits from overseas commercialization. | Shares development risks but has limited control over marketing strategy and sales outcomes; profits may be influenced by the partner. | Lower R&D and commercialization thresholds; suitable for companies with limited resources or early-stage internationalization. Provides quick access to capital and reduces financial pressure. |

| Potential Costs | Requires significant investment, strong global operational capability, and high risk tolerance. | Chinese companies may face limited control over overseas commercialization and strategic execution, potentially reducing profitability. | Companies may lose leadership in overseas R&D and commercialization processes. |

| Typical Examples | BeiGene’s Brukinsa (Zanubrutinib) was approved by the FDA in 2019 and achieved global sales exceeding USD 2 billion in 2024. | Junshi Biosciences partnered with Coherus in 2021 to co-develop Toripalimab for the U.S. and Canadian markets, and signed additional global development deals with multiple international partners. | In 2025, Hengrui Pharmaceuticals licensed its oral Lp(a) inhibitor HRS-5346 to Merck, receiving an upfront payment of USD 200 million and potential milestone payments of up to USD 1.77 billion. |

In this model, companies independently conduct clinical trials, regulatory submissions, and commercialization abroad, demonstrating full international capability. It requires strong R&D capacity and globally compliant teams.

Several Chinese cancer drugs, for instance, have passed rigorous international clinical trials and entered the U.S. and European markets. Though challenging, this path offers high profit margins and valuable global experience.

In recent years, as China’s innovative drug R&D accelerates, more homegrown drugs have gained U.S. FDA approval and launched directly in the United States.

On May 9, the U.S. Food and Drug Administration (FDA) announced that after completing its generative AI pilot for scientific reviewers, all FDA centers will now adopt AI-powered tools.

These systems help scientists reduce repetitive work and speed up drug review timelines.

(2) Cooperative Expansion — “Partnering for Growth”

Cooperative expansion refers to joint drug development between Chinese and overseas pharmaceutical companies, where both sides share costs and revenues.

For example, a domestic firm may provide innovative technology while the international partner contributes its clinical or commercial expertise.

This model reduces the risk of solo expansion and leverages partner resources to accelerate commercialization.

(3) License-Out Expansion — “Riding the Global Wave”

In the license-out model, Chinese drugmakers authorize overseas partners to develop, manufacture, and market their compounds abroad.

For instance, a Chinese colorectal cancer drug was licensed to a U.S. company, rapidly securing funding and entering the global market.

This model offers clear short-term returns and is particularly suitable for small to mid-sized enterprises aiming for quick international breakthroughs.

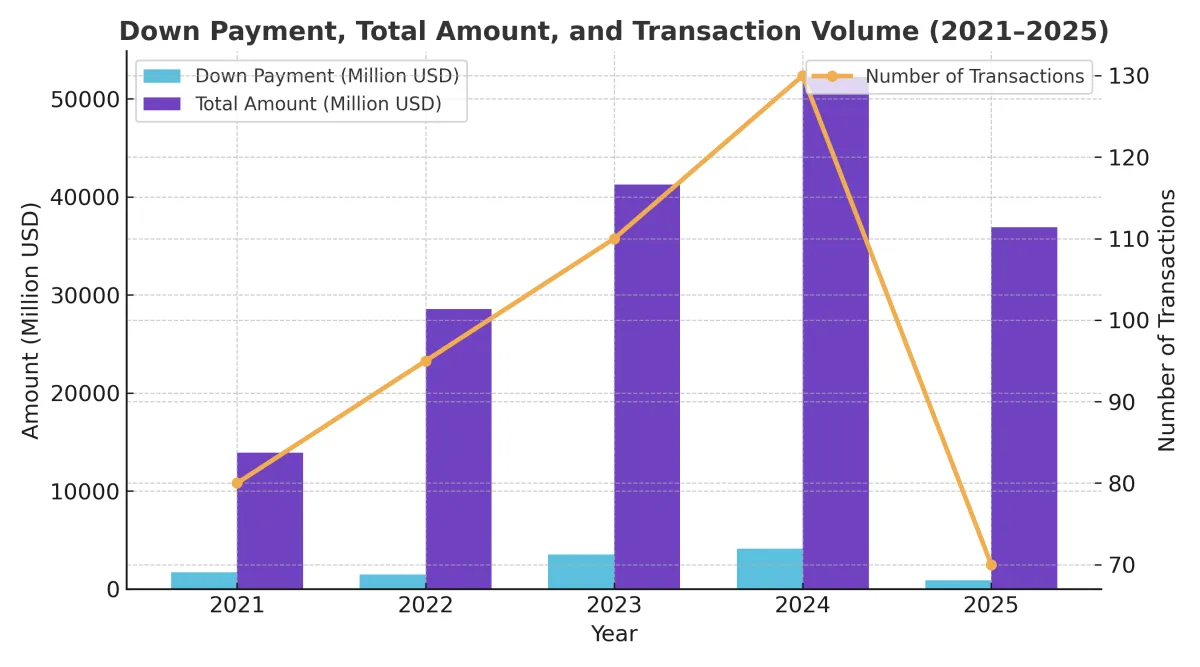

License-Out Deals Continue to Surge

Authorised Overseas Licensing Transactions for Innovative Drugs in China: Q1 2021–2025

According to DengYueMed’s analysis based on NextPharma data,

in Q1 2025, Chinese innovative drugmakers recorded 41 license-out deals worth a total of USD 36.93 billion.

In just three months, the transaction value nearly matched the entire 2023 total, surpassing the first half of 2024.

This surge reflects a booming business development (BD) landscape, reinforcing the trend of rapid performance growth and accelerating globalization among Chinese biopharma companies.

Three Strategic Benefits: Market, Technology, and Capital

Global expansion brings multiple advantages for China innovative drugs accelerate overseas:

- Larger Market Scale – e.g., a Chinese-developed cancer therapy surpassed USD 1 billion in global sales after entering the U.S. and EU markets.

- Technological Advancement – international collaboration raises R&D standards and accelerates the emergence of “first-in-class” drugs.

- Capital Reinforcement – overseas licensing revenues feed back into new R&D investment, forming a virtuous “R&D → Globalization → Reinvestment” cycle.

At the same time, government incentives, such as tax benefits and clinical trial subsidies, combined with rising global demand, have opened a dual circulation pathway—strengthening both domestic and international development.

Conclusion

Whether through independent expansion, cooperation, or license-out partnerships, each model plays a key role in driving China’s innovative drugs to accelerate overseas from follower to contender—and, in some areas, to global leader.

China Pharmaceutical Import and Export Wholesaler-DengYueMed will continue to monitor and analyze China’s biopharmaceutical globalization trends, offering strategic insights and data-driven perspectives to support the industry’s future growth.